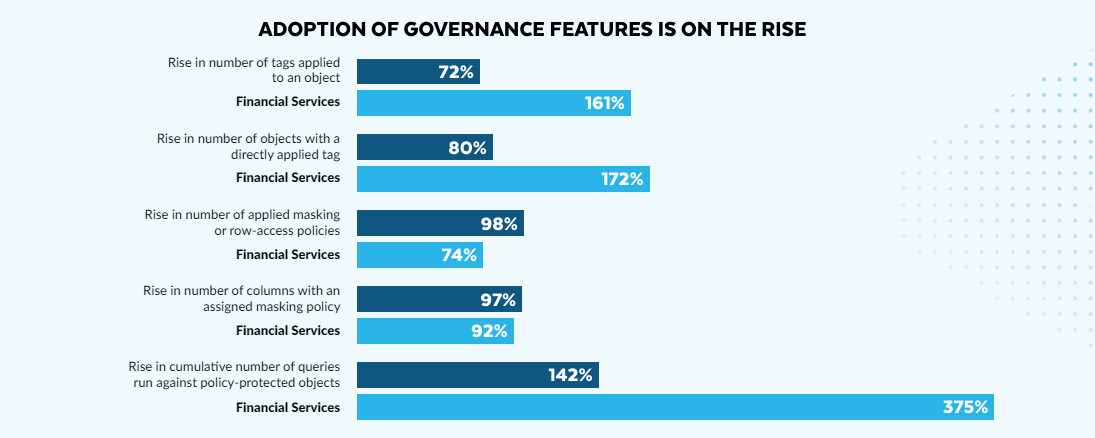

Efforts at data governance are rising across the board. In the Snowflake Data Cloud, this is evident in the increased use of tagging (for example, to identify sensitive policy-protected data) and masking (to restrict access to policy-protected data). In general, the use of data governance measures rose 70%–100% in the last year. Still, these added governance measures are not preventing organizations from unlocking the value contained in this data. Overall, the number of queries for access to policy-protected data assets rose 142%

across all industries over the last year, indicating that organizations are making deliberate, approved and proper use of their data. But over the same period for financial services, the increase was even greater, coming in at 375%. This can be attributed to the fact that financial services companies are both exceptionally data-driven and have the experience, motivation and skills required to do it more effectively

than organizations in most other industries. This should prove extremely helpful as financial firms evolve their use of AI.

As the graph below shows, the financial sector relies more heavily on tagging than masking, and came in a little below the general growth rate on applied masking and row-access policies, as well as masked columns. But the industry increase for tags applied to data objects was significantly over the average (nearly double the growth rate). This is most likely a result of previous governance efforts and well-established

access policies, spurred by government compliance requirements. Historically, financial service firms have used tags to protect data more than other industries.