Cost reduction has historically been the driver of changes to finance operating models. But that focus will evolve as new models look to expand Finance’s core capabilities and what it can deliver in partnership with other functions. Remote work, which proved its value during the pandemic, is here to stay, and leading finance organizations will be set up to accommodate it.

2018 prediction

New service delivery models will emerge as robots and algorithms join an expanded finance workforce that includes freelancers, gig workers, and crowds. Companies will assess the benefits of automation, which provides a new lever for managing costs, against onshore and offshore

operations.

2021 reality

The early days of COVID-19 underscored the benefits of having a distributed finance workforce equipped with effective collaboration tools and clearly defined work processes. It also highlighted the criticality of data security as people everywhere accessed corporate networks

remotely. Coming off the pandemic, many companies are having difficulty addressing rapid growth through existing FTEs and filling open finance positions through traditional recruiting channels.

2025 implications

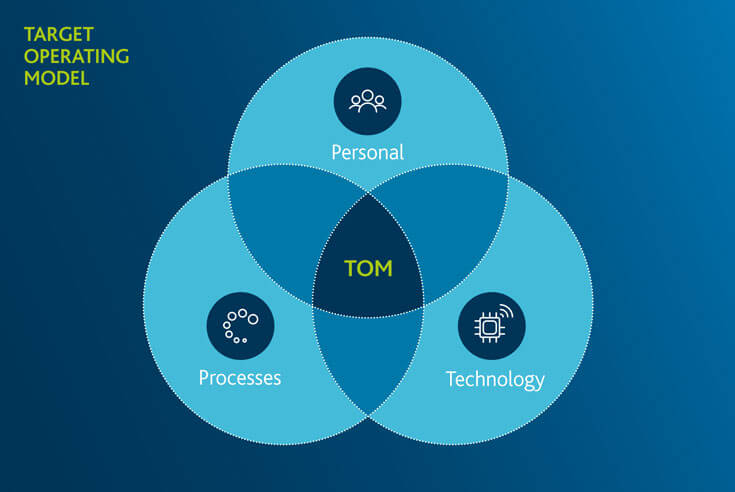

With a widely dispersed workforce, Finance will gain access to global talent pools and specialized resources. It also will make greater

use of freelancers and gig workers. As businesses prize new capabilities, some CFOs will adopt the “center-office” model, which emphasizes end-to-end processes, capabilities on demand, and coordination of external partner networks. In so doing, they’ll absorb responsibilities historically managed elsewhere.